how are property taxes calculated at closing in florida

The actual amount of the taxes is 477965. In Florida the transfer tax is usually.

Property Tax Prorations Case Escrow

Florida currently ranks number 23 for the amount of property taxes collected.

. To calculate the property tax use the following steps. Appraisal fees these are usually between 300 and 500. Common Florida Seller Closing Costs.

So when a home closes before the property tax bill arrives the title company will need to prorate taxes based on what the taxes were in the prior year. Buyers Title Insurance Cost and Closing Costs Itemized. Find the assessed value of the property being taxed.

In Florida similarly to other states closing costs are charges that applied to both parties in a real estate transaction the buyer AND the seller. This means that if your closing takes place anywhere between January and the first week of November the amount of the current years property taxes will not be known. 097 of home value.

Since the closing date does not line. If you add in Florida real estate commission which is typically 6 of the sale price closing costs in Florida can range up to 9 of the final sale price. The way in which these charges are being split is.

Youll pay around 16 of your homes final sale price in seller closing costs when you sell a home in Florida. Sellers Closing Cost Calculator. A millage rate is one tenth of a percent which equates to 1 in taxes for every 1000 in home value.

A number of different. Assessed Value - Exemptions Taxable Value. 16291 Sarasota County Fire Rescue a Non-Ad Valorem assessment 428066.

4200 12 350 per month. Lenders Title Insurance The buyer also provides the mortgage lender with a title insurance policy. Real Estate Agent Commission typically 5-6 of the sales price.

Just Value - Assessment Limits Assessed Value. Property taxes are paid every year with the money for property taxes held in escrow so the funds are available when its time to pay property taxes. As stated before the property taxes in Florida are based on the amount required in the previous year.

For a 367175 home the median home value in Florida youd. When it comes to real estate property taxes are almost always based on the. The real estate taxes for Property B are equal to 2000001000 x 215570 431140.

The documentary tax stamp rate is standard across Florida at 070 for every 100 of the homes purchase price. The only exception is Miami-Dade County. Divide the total annual amount due by 12 months to get a monthly amount due.

How Are Real Estate Taxes Prorated At the Closing. Buyers Closing Cost Calculator. This simple equation illustrates how to calculate your property taxes.

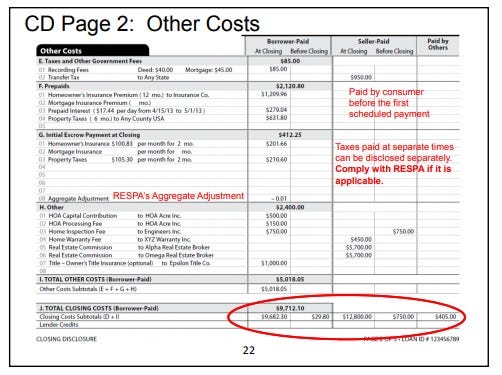

The actual amount of the taxes is 477965. Heres how to calculate property taxes for the seller and buyer at closing. During the closing process all parties typically sign a re-proration agreement which states that the property taxes will be re-calculated upon the arrival of the tax bill.

Assuming you intend to leverage the expertise of a qualified realtor and. The buyer typically pays between 3 to 4 of the home. Then when the actual tax bill arrives the buyer and seller pay or are refunded the difference.

Property Taxes in Florida. The median property tax in Florida is 177300 per year for a home worth the median value of 18240000. Tax amount varies by county.

Based on those numbers getting the per diem ie the per day. As mentioned above property taxes are not assessed until November of the year in which they are due. Property Tax Closing Costs in Florida How to Calculate the Required Amount.

Property taxes in Florida are implemented in millage rates. Heres an overview of the closing costs you can expect to pay when buying a home in Florida. Closing Fee The title company assesses this fee for their role in closing the.

The taxes are assessed on a calendar year from Jan through Dec 365 days. Real Estate Agent Commission typically 5-6 of the sales price. Neither party is responsible for 100 of the closing costs in Florida which includes fees taxes insurance costs and more.

Closing Cost and Sellers Net-Sheet Calculator. Property Taxes at a Closing in Florida In Florida property taxes are paid in arrears. For perspective the median.

Property tax bills in Florida arrive in early November and are for the calendar year.

Financial Information Needed To File A Tax Return For Your Vacation Property Schedule E Vacationlord

Closing Costs That Are And Aren T Tax Deductible Lendingtree

4 Things To Know About Closing Costs New Dwelling Mortgage

Property Tax Appeal Tips To Reduce Your Property Tax Bill

Midpoint Realty Cape Coral Florida Brochure Call Us 239 257 8717 Or Email Admin Midpointrealestate Com Condos For Sale Cape Coral Florida Boxes Easy

Coop Square Footage Nyc Hauseit Square Footage Nyc Co Op

First Time Home Buying From A First Time Home Buyer Buying First Home Home Buying Home Buying Process

Wtf Is The Aggregate Adjustment On My Closing Disclosure By Jeffrey Loyd Medium

Your Guide To Property Taxes Hippo

How To Read A Buyer S Closing Disclosure Florida S Title Insurance Company

Your Guide To Property Taxes Hippo

Free Printable Checklist For 1st Time Home Buyers 17 Critical Steps First Home Checklist Buying First Home Home Buying Checklist

1sttimehomebuyers Home Buying Credit Card Realistic

What Should Homebuyers Ask Themselves Before Entering The Market Real Estate Buyers Home Buying Real Estate Buying

Closing Costs Calculations Practice Video Lesson Transcript Study Com

Understanding Property Taxes At Closing American Family Insurance

Your Guide To Prorated Taxes In A Real Estate Transaction

First Time Home Buyer Vocab Cheat Sheet With The Top 10 Terms Used During The Home Buying Process Home Buying First Home Buyer Home Buying Checklist